Heads Up: When you purchase through links on our site, we may earn an affiliate commission at no cost to you.

Are you struggling to understand how to assess the value of your investment properties? Many real estate investors overlook critical analysis fundamentals, impacting their cash flow and overall wealth. This essential guide will cover key metrics for evaluating investment properties, conducting comparative market analysis, and strategies to maximize property value. By engaging with this content, you’ll gain valuable insights to help you make informed decisions and improve your asset management. Let’s tackle the complexities of investment property analysis and enhance your financial outcomes with reliable statistics and practical advice.

Key Takeaways

- Analyzing financial metrics helps identify profitable investment properties.

- Understanding local market trends is key to making informed decisions.

- Effective property management maximizes value and reduces turnover costs.

- Investing in property improvements enhances appeal and income potential.

- Networking and education are essential for staying updated on market dynamics.

Understanding Investment Property Analysis Fundamentals

Understanding investment property analysis is essential for maximizing your profit potential. By developing strong analytical skills, you can identify properties that offer the best returns. This process not only reflects your leadership in decision-making but also enhances your overall investment strategy.

A key aspect of property analysis involves examining various financial metrics. These analytics allow you to gauge a property’s viability. Metrics like cash flow, return on investment, and capitalization rates help you assess whether a property meets your profit expectations.

Understanding market trends and property values can significantly impact investment decisions. Staying abreast of local market conditions contributes to making informed choices. This knowledge is vital for evaluating available opportunities and their potential financial outcomes.

By building a solid foundation in investment property analysis, you position yourself for success. Knowing how to interpret financial data equips you to make strategic decisions. Mastery of these concepts leads to higher potential profits and improved long-term investment performance:

- Gain insights through analytics.

- Evaluate key financial metrics.

- Monitor local market trends.

- Make informed investment choices.

- Instant feedback

- Valuable insights

- Actionable tips

Key Metrics for Evaluating Investment Properties

Cash flow projections are vital for understanding a property’s potential, while ROI and cap rate provide insights into profitability. Analyzing property appreciation rates helps you gauge long-term value. Evaluating operating expenses is essential for accurate financial planning, and different financing options can help manage debt and assess financial risk. These elements contribute significantly to effective investment management.

Exploring Cash Flow Projections

Understanding cash flow projections is fundamental for any real estate investor. By using the cash flow formula, you can assess all income and expenses related to a property, including property tax. This analysis provides confidence in your investment decisions, allowing you to identify whether a property will generate positive cash flow or lead to financial strain.

Your cash flow projections should reflect immediate returns and consider long-term trends typical in private equity investments. Real estate investing is often a textbook example of using projected cash flow to secure financing or guide future investment decisions. By continuously refining your cash flow analysis, you can adjust your strategy and make more informed choices in the competitive real estate market:

| Income | Expenses |

|---|---|

| Rental Income | Property Tax |

| Other Income | Maintenance Costs |

| Total Income | Total Expenses |

| Net Cash Flow |

Understanding ROI and Cap Rate

Understanding the rate of return is critical for evaluating investment properties. This metric measures the profitability of your investment compared to the amount invested, expressed as a percentage. Knowing this allows you to make informed decisions about which properties to pursue. For example, suppose a broker presents a potential investment with a high rate of return. In that case, it indicates that the property could generate substantial passive income over time, making it an attractive option.

The gross rent multiplier (GRM) is another valuable tool when assessing investment properties. This method calculates how long it will take for an investment property to pay for itself based on its rental income. By evaluating the GRM along with the rate of return, you can better understand the property‘s potential and the associated risks. This knowledge helps you confidently navigate your investment choices, ensuring that you select properties that align with your financial goals and aspirations.

Analyzing Property Appreciation Rates

Analyzing property appreciation rates is crucial in your real estate investing journey. Understanding how a property’s value changes over time allows you to make better-informed decisions. Factors such as supply and demand in your local market can heavily influence these rates, so staying updated on community developments and economic trends will enhance your real estate appraisal accuracy.

Incorporating appreciation analysis into your investment strategy helps assess potential properties and aligns with your financial goals. For example, if you’re considering a down payment for a real estate investment trust (REIT), analyzing historical appreciation trends can guide you in selecting investments with promising growth. This insight provides a stronger foundation as you aim to build a successful investment portfolio that meets your objectives.

Evaluating Operating Expenses

When evaluating operating expenses, it’s essential to consider all costs associated with property management. This includes regular expenses such as maintenance, utilities, and property taxes, and less frequent costs like major repairs or capital improvements. Understanding these expenses allows you to accurately assess the property‘s profitability and potential returns, helping you make informed investment choices that align with your financial objectives in a fluctuating capital market environment.

It’s also wise to factor in external influences such as sea level rise and its potential impact on property values and insurance costs. By staying aware of these trends, you can better position your investment for long-term viability, particularly in areas with significant employment opportunities that can support rental demand. Ultimately, knowing how to evaluate operating expenses effectively equips you to develop a sustainable investment strategy that mitigates risk while maximizing your returns.

Considering Financing Options and Impact

Understanding the concept of leverage is crucial when considering financing options for investment properties. Leverage can significantly enhance your cash flow statement by allowing you to borrow against the property to purchase additional assets, increasing your overall potential returns. However, assessing the zoning regulations in your target area is essential, as these factors can affect both future property value and your financing options.

Additionally, you should evaluate how different financing methods impact the present value of your investment. For instance, using a life insurance policy as collateral for a loan might offer favorable terms while minimizing risk. Being informed about various financing options empowers you to make strategic decisions that align with your financial goals and enhances your ability to secure profitable investments.

Conducting Comparative Market Analysis

To conduct a comparative market analysis effectively, you must identify properties comparable to your investment target. Gathering market data and trends helps you understand pricing dynamics while assessing location and neighborhood factors, which ensures a better value estimation. Additionally, evaluating property features and conditions and analyzing historical price trends provides the knowledge to establish a well-rounded sensitivity analysis for your investment approach.

Identifying Comparable Properties

Identifying comparable properties involves finding similar real estate assets within your target area to establish a reliable basis for valuation. By examining factors such as operating expenses, size, location, and amenities, you can create a more accurate assessment of your potential investment. When selecting comparables, consider how attributes like depreciation and amortization may affect the financial performance reflected on a balance sheet.

For instance, you could analyze properties with similar rental income and examine their gross rent multipliers to determine how your property measures up. Recognizing these indicators helps you gauge realistic expectations regarding cash flow and potential profits. Taking the time to identify and analyze comparable properties ensures that you are making informed and strategic investment decisions, paving the way for long-term success in real estate.

Gathering Market Data and Trends

Gathering market data is critical in conducting a comparative market analysis for your investment property. By examining recent sales figures, rental rates, and property features in your area, you can establish a reliable valuation framework. This information not only aids in determining the potential return on investment but also allows you to identify trends in real estate development that could impact future property values, such as new construction projects or retail expansions in the vicinity.

Staying updated on local market conditions will help you make informed decisions about your investment. For example, if you’re considering financing through a home equity loan, understanding the current market dynamics and value trends can help you assess the risk and opportunity of your investment. Accurate market analysis can guide you in selecting properties that fit your investment strategy and position you for better long-term financial outcomes.

Assessing Location and Neighborhood Factors

When evaluating potential investment properties, it’s important to assess location and neighborhood factors. A property’s proximity to schools, public transport, shopping centers, and green spaces can significantly affect its desirability, ultimately impacting its potential net income. Additionally, any regulations or zoning laws that might apply in the area should be considered, as these can shape investment opportunities and limit future development changes.

Understanding the social and economic dynamics of the neighborhood can also provide insights into the area’s long-term prospects. For instance, neighborhoods with sustained investment and development often promise better returns for investment trusts. By conducting thorough research and analysis on these aspects, you can make sound decisions that align with your investment strategy and enable you to navigate potential pitfalls in the market:

| Factor | Impact on Investment |

|---|---|

| Proximity to Amenities | Increases demand and rental rates |

| Zoning Laws | Affects future development possibilities |

| Neighborhood Trends | Indicates potential for appreciation |

| Economic Conditions | Impacts property values and net income |

Evaluating Property Features and Conditions

When evaluating property features and conditions, you should consider both the physical attributes of the property and its overall maintenance needs. This assessment plays a critical role in your cash flow projections, as well-maintained properties typically require fewer repairs, directly influencing your operational budget. Conducting thorough research on construction quality, age, and amenities can equip you with essential insights for making informed investment decisions.

Incorporating a systematic approach to this analysis allows you to perform accurate risk assessment, helping you determine potential financial pitfalls. You enhance your strategic management capabilities by using effective mathematics to gauge the implications of property features on your investment strategy. Understanding these elements ensures you choose properties that meet immediate needs and align with your long-term investment aspirations, supporting consistent revenue generation.

Analyzing Historical Price Trends

Analyzing historical price trends is vital to making informed decisions as a landlord or real estate investor. By studying how property values have changed over time, you can better anticipate future market behavior and identify opportunities that promise a solid return on investment. Collaborating with a knowledgeable real estate agent can provide valuable insights into past sales data, helping you gauge the potential performance of your investment.

Using the sales comparison approach, you can evaluate comparable properties to understand price movements in your target area. This method focuses on historical sales and considers factors affecting value, such as economic conditions and neighborhood developments. When applying for a commercial mortgage, having this analytical depth can significantly strengthen your position, allowing you to present compelling arguments about potential returns on your investment.

- Understand the significance of historical price trends.

- Utilize the sales comparison approach for property evaluation.

- Gather insights from a real estate agent for data accuracy.

- Consider the impact of local economic conditions on property values.

- Prepare persuasive arguments for securing a commercial mortgage.

Risk Assessment in Investment Property Analysis

Effective risk assessment is vital for a robust investment strategy. In this course, you will explore identifying market risks that influence property values, understanding legal and regulatory risks that can affect ownership, and evaluating financial risks, such as expenses that impact your capitalization rate. Additionally, considering physical property risks and the broader economic conditions will equip you to make informed decisions that enhance your financial analysis.

Identifying Market Risks

Identifying market risks is crucial when conducting a market analysis for investment properties. Economic downturns, shifts in local demand, and changes in zoning laws can influence property values and rental income. Consider how an evolving economy impacts equity; if job growth slows, you may face challenges in maintaining rental income, putting your investment at risk.

Employing the income approach in your assessments can help you recognize potential market risks. This method estimates future income to inform your investment decisions. By understanding the interplay between your expenses, anticipated revenue, and local market conditions, you can create a more resilient strategy to protect your investment against unforeseen changes that may impact its profitability.

Understanding Legal and Regulatory Risks

Understanding legal and regulatory risks is crucial for your investment property analysis, as they can significantly affect your investment’s viability. For instance, zoning laws can impact property demand and how you plan to use the real estate. Moreover, ensuring that your property meets local regulations helps protect you from potential fines. It can affect your property insurance costs, influencing your overall financial considerations within your discounted cash flow model.

Stay informed about local laws and regulations that affect your investment decisions. Engaging with real estate legal professionals can provide valuable insights and help you navigate the complexities arising from compliance issues. By equipping yourself with this knowledge, you can better assess your investments, align them with your business strategies, and potentially optimize your returns while minimizing risks associated with legal complications.

Evaluating Financial Risks

Evaluating financial risks is critical when assessing your investment property. One key factor to consider is the impact of mortgage terms on your cash flow. Securing a mortgage with high interest rates can significantly strain your budget, reducing profit margins. Additionally, understanding the obligations outlined in tenant lease agreements is essential, as bad leases can lead to unexpected costs and voids in rental income, thus impacting your overall financial health.

Another aspect of financial risk involves asset management, particularly maintenance costs like roof repairs. Neglected upkeep can result in costly replacements that may not be accounted for in your initial investment calculations. Discounting methods can also help you evaluate the long-term viability of your investments by assessing future expenses against current financial returns. By recognizing these financial risks, you can make informed decisions that protect your investment and enhance your overall profitability.

Considering Physical Property Risks

When considering physical property risks, evaluating the condition and maintenance needs of the real property is essential. Neglecting basic upkeep can dramatically affect the market value of your investment. For instance, if a roof needs significant repairs, it will not only strain your budget but also impact your internal rate of return, as poor conditions may deter potential tenants.

Additionally, highlighting any physical property issues can provide leverage to secure better terms during negotiations for purchases or refinancing. Understanding these risks allows you to take proactive measures, such as budgeting for necessary repairs and ensuring that your investments align with your overall strategy. This proactive approach supports a healthier and more sustainable investment portfolio, ultimately promoting long-term success.

| Physical Risk Factor | Potential Impact on Investment |

|---|---|

| Deferred Maintenance | Decreases market value and internal rate of return |

| Structural Issues | This may lead to regulatory issues and increased costs |

| Environmental Concerns | May lead to regulatory issues and increased costs |

| Market Value Changes | Influences refinancing options and negotiation power |

Impact of Economic Conditions on Investments

Understanding how economic conditions impact real estate transactions is vital for successful investments. Fluctuations in revenue can directly affect your property’s cash flow and overall value. For example, during an economic downturn, you may experience higher vacancy rates, leading to diminished income and making securing credit for future projects more challenging.

Additionally, the economic environment can influence your pro forma projections. A strong economy might enable you to forecast higher rental rates and increased demand, whereas a recession could lead to more conservative estimates. Being aware of these factors allows you to make smarter decisions aligned with your business strategy, particularly if you’re pursuing a Master of Business Administration that emphasizes real estate management.

Strategies for Maximizing Investment Property Value

To maximize the value of your investment property, focus on key strategies such as implementing property improvements and effective management techniques. Enhancing curb appeal boosts your asset‘s price and attracts potential tenants. Understanding rent maximization techniques and evaluating long-term investment strategies can significantly reduce risk amid fluctuating interest rates while considering the time value of money. These insights ensure you make informed decisions that align with your financial goals.

Importance of Property Improvements

Improvements to your investment property can significantly enhance its appeal and value. By focusing on upgrades that align with market demands, you make the property more attractive to potential tenants and increase the overall income potential reflected in your income statement. Utilizing tools like Microsoft Excel for financial modeling can help you project the impact of these enhancements on your bottom line, allowing for a more informed underwriting process when assessing the viability of these alternative investments.

Moreover, investing in property improvements leads to a better return on investment by increasing both market value and rental rates. For instance, updating kitchen and bathroom fixtures can create a strong first impression, leading to higher income generation. Understanding these changes can empower you to make strategic decisions that increase profitability and ensure tenant satisfaction, ultimately positioning your investment for long-term success in a competitive real estate market.

Strategies for Effective Property Management

Effective property management is vital for maximizing the value of your investment. A clear policy regarding tenant relationships can create a trustworthy environment that encourages long-term leases. This strategy helps maintain consistent cash flow and reduces turnover costs, allowing you to reinvest in enhancing your property.

Additionally, utilizing diversification strategies within your property portfolio can further safeguard your investments. By spreading your assets across different real estate types, you lower risks while positioning yourself for better returns. This approach enables you to navigate market fluctuations more effectively, ensuring your investment trust remains resilient and profitable.

Enhancing Curb Appeal

Enhancing curb appeal is a critical strategy for maximizing your investment property value. Landscaping, fresh paint, and an inviting entrance can attract potential tenants while increasing your property’s marketability. This improvement serves as an effective risk management tactic and can positively impact your home equity ratio, allowing you to leverage your property more effectively in future investments.

As you improve curb appeal, consider the principles outlined in your real estate curriculum. Simple updates such as maintaining a clean exterior and well-kept gardens can elevate the first impression your property makes. These enhancements can lead to quicker tenant placements and higher rental rates, ultimately contributing to a stronger overall investment strategy that aligns with your financial objectives.

Understanding Rent Maximization Techniques

Understanding rent maximization techniques can significantly enhance the performance of your investment property. One effective strategy is conducting regular market analyses to ensure your rental rates align with current trends and local demand. For instance, if similar properties in your area command higher rents, adjusting your pricing accordingly attracts tenants and improves your overall cash flow.

Another approach to rent maximization involves enhancing your property’s appeal through upgrades and professional management. Simple improvements, such as modern fixtures or energy-efficient appliances, can justify higher rents while improving tenant satisfaction. By implementing these techniques, you position yourself to optimize rental income, ensuring your investment aligns with your financial objectives and delivers maximum value over time.

Evaluating Long-Term Investment Strategies

Evaluating long-term investment strategies requires considering how market trends and economic conditions will impact your properties. For instance, you should analyze neighborhood developments and infrastructure improvements, as these factors can significantly enhance property values and rental income. Adopting a forward-thinking approach allows you to capitalize on emerging opportunities that can lead to substantial returns.

Incorporating a diversified investment portfolio is another key strategy for long-term success. By spreading your investments across different types of properties or locations, you can mitigate risks associated with market fluctuations and maintain consistent cash flow. This strategy stabilizes your income and allows you to adjust your investments based on performance, ensuring that you remain aligned with your financial goals over the long term.

Case Studies in Investment Property Analysis

Case Studies in Investment Property Analysis

This section examines examples of successful investment properties, highlighting effective strategies and outcomes. It also offers valuable lessons from failed investments, offering insights into what to avoid. Analyzing diverse property types reveals how various markets influence success. Lastly, recommendations based on case findings empower you to make informed decisions in your investment journey.

Successful Investment Property Examples

One successful example of investment property analysis can be seen in urban multifamily buildings. Investors who closely studied local rental demand patterns found properties that yielded consistent occupancy rates and high rental yields. By applying metrics such as cash flow analysis and return on investment calculations, they decided on purchases that enhanced their portfolios and ensured steady cash flow, allowing them to reinvest their profits into further opportunities.

Another notable case involves an investor who focuses on commercial properties in rapidly growing neighborhoods. The investor identified an undervalued office building in an area with promising economic development by conducting thorough market research and evaluating factors like appreciation rates and neighborhood trends. The investor’s strategic approach included enhancing the property value through renovations and effective management, significantly increasing rental income and overall property valuation.

Lessons From Failed Investments

Understanding what led to failed investments is crucial for your growth as a real estate investor. One common pitfall is ignoring proper due diligence, which can lead to unforeseen expenses or unfavorable property conditions. For instance, some investors may rush into purchasing a property without assessing the local market trends and potential for appreciation, resulting in losses that could have been avoided with thorough research.

Another significant lesson is recognizing the impact of high leverage on investment stability. Investors who overextended themselves financially often faced challenges during market downturns, leading to difficulties covering mortgage payments. By studying these failures, you can develop better risk management strategies that focus on balance and sustainability, allowing you to pursue rewarding investment opportunities while protecting your financial interests:

| Investment Pitfall | Impact on Investment |

|---|---|

| Lack of Due Diligence | Unforeseen expenses and poor property conditions |

| High Leverage | Financial strain during market downturns |

Analyzing Diverse Property Types

When analyzing diverse property types, it is essential to recognize the unique characteristics and investment potential associated with each. For example, residential properties often yield stable rental income due to consistent demand, while commercial properties can offer higher returns but usually entail longer vacancy periods. Understanding these differences allows you to tailor your investment strategies accordingly, prioritizing properties that align with your financial goals and risk tolerance.

Furthermore, conducting a thorough analysis of property types helps you identify market trends and demand fluctuations. For instance, evaluating urban multifamily housing opportunities in growing neighborhoods can reveal promising investment potential. By staying informed about the varying dynamics among diverse properties, you position yourself to make strategic decisions that enhance your overall investment portfolio and lead to greater profitability:

- Recognizing unique characteristics of property types.

- Prioritizing investments based on financial goals.

- Identifying market trends and demand fluctuations.

- Making strategic decisions for your investment portfolio.

Impact of Different Markets on Success

The success of your investment property largely hinges on the market in which you operate. For instance, properties located in high-demand urban areas often experience quicker tenant placements and lower vacancy rates, leading to enhanced cash flow. By studying market dynamics and identifying regions with strong economic growth, you can position yourself to make profitable investments that yield substantial returns.

Recommendations Based on Case Findings

Learning from past case studies is essential to maximizing success in real estate investing. When analyzing successful and unsuccessful investments, focus on the importance of thorough due diligence. Always evaluate market demand and property conditions to avoid unforeseen expenses that could derail your financial plans. Understanding these factors will enhance your ability to make informed decisions and position you for better returns.

Additionally, recognizing market dynamics is vital for maintaining a successful investment portfolio. Assess how different economic conditions influence property performance to guide your strategy. For instance, diversifying your investments across various property types and locations can mitigate risks related to any single market downturn, ensuring sustained profitability. By implementing these recommendations, you can strengthen your investment approach and achieve your financial goals more effectively.

Resources for Ongoing Education in Property Analysis

To enhance your investment property analysis skills, explore various resources. Recommended books and online courses can provide foundational knowledge while using analytical tools and software to help streamline your processes. Networking in real estate offers valuable connections, and staying informed on market trends prepares you for challenges. Joining professional organizations also provides essential support for ongoing education.

Recommended Books and Courses

Consider reading foundational books such as Brandon Turner’s The Book on Rental Property Investing to enhance your understanding of investment property analysis. This resource offers practical insights into cash flow management and ROI calculations, supporting your journey in property investment. Additionally, online courses, such as those offered by sites like Coursera or Udemy, can provide structured learning on key metrics and market analysis, allowing you to deepen your knowledge and refine your strategies.

Another valuable resource is “Real Estate Investing for Dummies,” which breaks down complex concepts into easy-to-understand sections. This book helps you grasp essential ideas about property evaluation and financial analysis. Participating in webinars hosted by experienced investors or real estate professionals can offer real-world tips and help you stay updated on current market trends, further empowering you to make informed investment decisions.

Online Tools and Software for Analysis

Using online tools and software can significantly streamline your investment property analysis process. Platforms like Zillow and Redfin provide access to comprehensive property data, market trends, and recent sales information, enabling you to make informed decisions quickly. Additionally, utilizing specialized software like PropertyREI or Investimate can help synthesize financial metrics and projections, allowing you to evaluate properties more effectively.

These tools simplify the analysis and enhance your ability to conduct in-depth evaluations. For instance, you can adjust your strategy by tracking local rental rates and vacancy trends. Staying informed with real-time data helps you seize emerging opportunities and manage risks efficiently:

| Tool/Software | Purpose |

|---|---|

| Zillow | Access to property data and market trends |

| Redfin | Recent sales information for informed decision-making |

| PropertyREI | Synthesize financial metrics and projections |

| Investimate | Evaluate properties effectively with financial analysis |

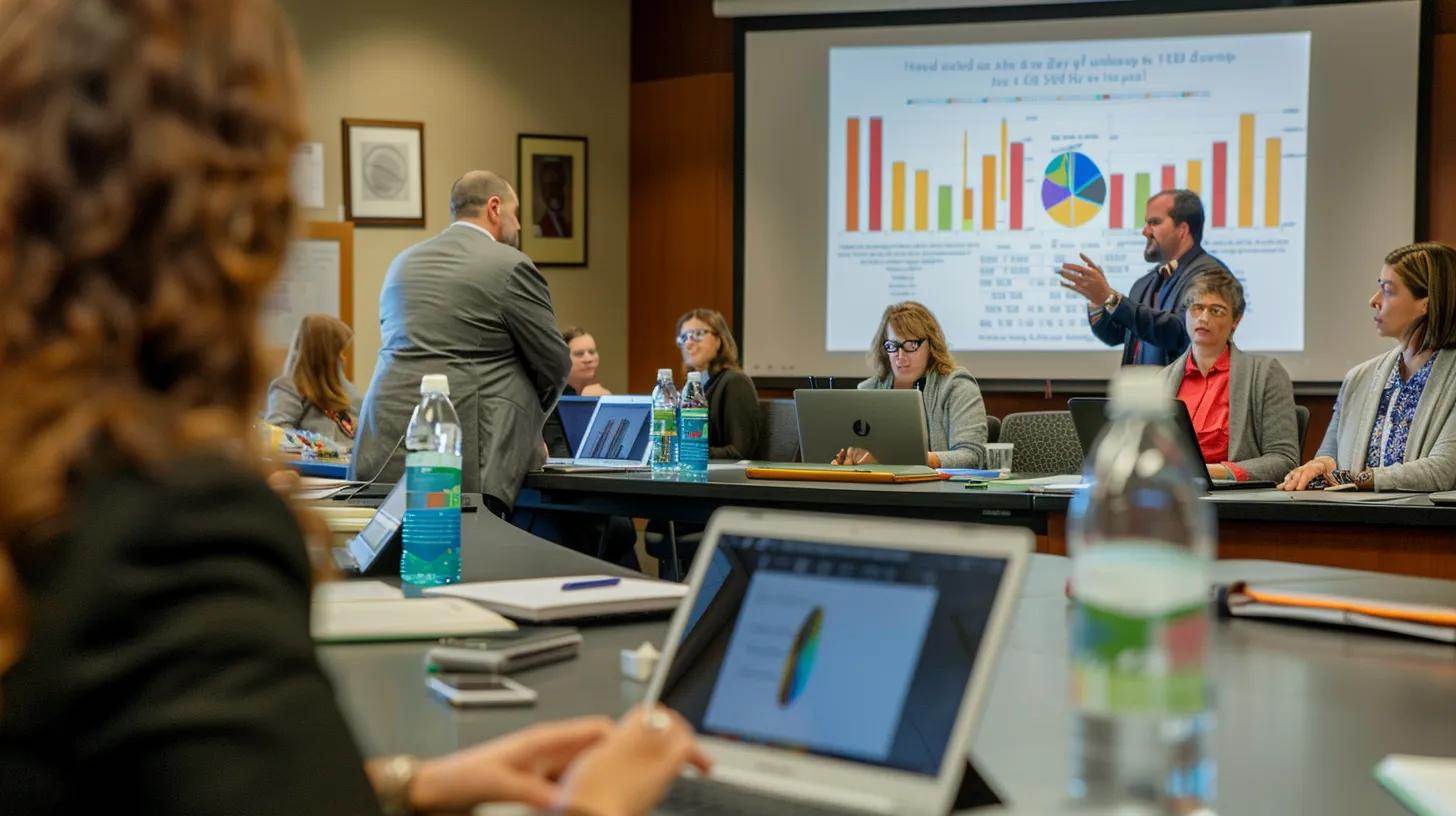

Networking Opportunities in Real Estate

Networking in real estate is invaluable for expanding your knowledge and opportunities. By attending industry conferences, local meetups, or joining real estate investment groups, you can connect with other investors, brokers, and industry professionals who can share successful insights and strategies. These connections often lead to partnerships and mentorships that significantly enhance your understanding of investment property analysis.

Additionally, leveraging online platforms like LinkedIn and real estate forums can help you stay updated on market trends and connect with like-minded individuals. Engaging in discussions and exchanging ideas with other professionals broadens your perspective and provides access to resources and opportunities that can elevate your investment strategies. Building a strong network empowers you to navigate challenges and seize new opportunities in the competitive real estate landscape.

Importance of Staying Updated With Market Trends

Staying updated with market trends is crucial for real estate investors, as they directly affect investment decisions and strategies. Knowledge of local market dynamics, such as changes in rental rates, inventory levels, and economic indicators, enables you to anticipate potential opportunities and challenges. For instance, if you notice a rise in demand for rental properties in a specific neighborhood, you can proactively adjust your investment approach to capitalize on this trend and increase your chances of securing profitable deals.

Regularly monitoring market trends helps identify promising investment areas and equips you with the insights needed to manage your properties efficiently. Understanding upcoming developments like infrastructure improvements or zoning changes can better position your investments for long-term growth. Consider subscribing to real estate news outlets, attending local property seminars, or joining networking groups to ensure you stay informed about the latest market shifts and trends that could impact your real estate portfolio:

- Importance of real-time market insights.

- Strategies to anticipate trends effectively.

- Tools and resources for staying informed.

Joining Professional Organizations for Support

Joining professional organizations can significantly enhance your knowledge and network in investment property analysis. These groups often provide access to valuable resources, including industry publications, webinars, and networking events, which can help you stay informed about market trends and best practices. Connecting with seasoned professionals through these organizations also allows you to gain insights that can refine your analytical skills and improve your investment strategies.

Participating in these organizations offers opportunities for mentorship and collaboration with other investors who share similar goals. You can learn from their experiences, share challenges, and discuss strategies that have proven successful in their investment journeys. This support system fosters professional growth and empowers you to make well-informed decisions, ultimately positioning you for greater success in the competitive real estate landscape.

Conclusion

Mastering investment property analysis is crucial for real estate investors aiming to maximize their returns. By focusing on essential metrics such as cash flow, ROI, and market trends, you position yourself to make informed and strategic decisions. Incorporating thorough risk assessments and comparative market analyses enhances your ability to navigate challenges effectively. A solid understanding of these fundamentals ultimately empowers you to build a successful investment portfolio that aligns with your financial objectives.